POLITICAL AND DIPLOMATIC ASPECTS OF RUSSIA’S ENERGY WAR AGAINST UKRAINE AND THE EU: CONSEQUENCES AND COUNTERMEASURES

Group of authors:

Mykhailo Gonchar, Oksana Ishchuk, Ihor Stukalenko

1. INTRODUCTION. SECRETS ARE NEVER LONG-LIVED

“Very clearly Russia is using gas as a weapon of war and we must prepare for the worst case scenario of a complete interruption of supplies,” this direct statement by French Energy Minister Agnès Pannier-Rounche[1] on August 30 can be considered an indicator of the final epiphany of European officials regarding Russia and its long-term energy strategy called “supply, corrupt and make dependent” on the continent.

Vice President of the European Commission and EU High Representative for Foreign Affairs and Security Policy Josep Borrell also bluntly noted in his September 4 post: “For decades, our energy dependence has been a limiting factor to the development of a more robust EU stance on Russia and respond to Putin’s authoritarian and aggressive policies.”[2]

What looks like a revelation for Europe has long been clear to Ukraine. Moreover, Russian energy expansionism was openly declared back in the first edition of the Energy Strategy of the Russian Federation up to 2020. It begins with a candid statement: “Russia possesses significant reserves of energy resources and a powerful fuel and energy complex, which is the basis of economic development and a tool for implementing domestic and foreign policies.”[3] The document was adopted in 2003—that is, during the early Putin period.

For many years, the Russian propaganda narrative about the absolute reliability of Russia as a gas supplier and the unreliability of the Ukrainian transportation route was promoted in EU countries.

Meanwhile, the European Union’s dependence on Russian gas was growing. Over the past decade, according to the IEA, the share of Russian gas, both pipeline and liquefied, in meeting total EU demand has increased from 30% in 2009 to 47% in 2019 (see Figure 1). In fact, without realizing it, the European Union and Germany as its leading economic and political force gave Putin’s Russia the green light at the beginning of the 2000s to implement the old, Cold War-era plan of European dependence on energy resources from the USSR.

Figure 1.Share of gas demand that is covered by Russian gas supply, 2001-2022, %.

Source: Analysis by the Strategy XXI Centre based on data from IEA and other sources

Following the Russian military invasion of Ukraine, EU policy has begun to change dramatically. The speech of the President of the European Commission Ursula von der Leyen on September 14, 2022 “State of the Union 2022”[4] shows a historic shift in energy policy: “Last year, Russian gas accounted for 40% of our gas imports. Today it’s down to 9% pipeline gas.” The point is that it has already been possible to replace Russian gas to some extent with increased imports from Norway, Algeria and liquefied natural gas from the United States.

One can hope that the words of Federal Chancellor Olaf Scholz “…what was always the case during the Cold War is not working anymore. Russia is no longer a reliable partner for energy supplies”[5] symbolize the Rubicon crossed by Germany and the EU as a whole in assessing the Kremlin’s actions in Europe, and the point of no return has been passed. The actions of the German government to nationalize the assets of Russian state companies in Germany and the willingness of German companies to sue Gazprom are evidence of this, although a final conclusion can only be drawn in the spring of 2023.

2. PERPETUUM MOBILE OF THE RUSSIAN WAR IN EUROPE

Revenues from the export of fossil fuels are the main financial engine of Russia’s military and subversive activities in the world, including those against Ukraine, which Moscow has been conducting since 2014. The phase of a full-scale armed invasion along a front of more than 2,500 km has been going on for seven months. Although the EU has imposed seven sanctions packages, they have not stopped the flow of money from Europe to Russia. Revenues from oil, petroleum products, and natural gas exports continue to fuel Russia’s aggression against Ukraine and Europe. In fact, in 2022, Russia spends on the war and earns from the war at the same time, as military action and sanctions contribute to the unwinding of the energy price spiral in the EU market, where Moscow is the dominant supplier. The war provides temporary benefits to the oil and gas sector of the Russian Federation, especially in circumstances where the oil embargo has not been fully implemented and schemes to bypass it have been worked out in parallel.

Although the EU, the U.K., the U.S. and Canada refuse from Russian energy sources, the unprecedented growth of their prices, as well as the policy favorable to Moscow pursued by the Asian powers, such as China, India, and Türkiye, and Hungary’s strike-breaking position within the EU, are bringing in additional revenues for Russia.

The amount of Russia’s energy exports in 2022 will probably be close to $330-350 billion. This exceeds the value of Russia’s gold and foreign exchange reserves frozen under Western sanctions, which amount to about $300 billion[6]. Despite the estimates disseminated in the world media, this figure is not a record against the background of the 2012-2014 results, when the RF received more than $300 billion from the export of energy resources each year (see Table 1 below).

While the partial oil embargo under the VI sanctions package has not come into force, and no embargo on gas is foreseen until after the winter of 2022-2023, Russia is receiving additional revenues from higher oil prices, boosted through the OPEC+ cartel, and gas tariffs, which Gazprom has escalated in Europe. Consequently, Russia has the ability to continue to finance an aggressive war in Europe, using mainly military means on the Ukrainian front and hybrid tactics in the EU—energy blackmail, propaganda, provoking social protests, and corruption in order to politically destabilize “unfriendly” EU member states and the Union as a whole.

Table 1. Energy Exports of the Russian Federation*, 2012-2022.

| Export indicators $ billion/year | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022** |

| Crude oil and oil products | 280,0 | 282,9 | 269,7 | 157,0 | 119,6 | 151,6 | 207,1 | 188,3 | 117,7 | 180,1 | ~250 |

| Natural gas | 63,0 | 67,2 | 55,2 | 46,4 | 31,2 | 38,7 | 49,1 | 49,5 | 32,0 | 55,5 | ~80 |

| Coal | 13,0 | 11,9 | 11,8 | 9,6 | 9,1 | 13,9 | 17,0 | 15,9 | 12,4 | 17,6 | ~20 |

| Energy Export | 366,0 | 362,0 | 336,7 | 213,0 | 159,9 | 204,2 | 273,2 | 253,7 | 166,9 | 253,2 | ~330 – 350 |

| Total exports | 524,7 | 526,4 | 496,9 | 345,9 | 287,5 | 359,8 | 452,1 | 424,6 | 331,7 | 493,3 | ~550 – 570 |

* Based on data from the Federal Customs Service, Rosstat and the Russian Central Bank

** Forecast estimate by the Centre based on Russian and Western data for the first half of the year and 8 months of 2022.

From 2023, when the full EU oil embargo comes into effect (with the exception of supplies through the Southern Druzhba pipeline), the situation will change dramatically, and Russia expects a reduction of petrodollar flow. That is why the Kremlin decided in summer on the concealed mobilization, disguised as an “grassroots initiative” to create regional volunteer battalions and to increase the RF Armed Forces by 137 thousand people[7], while the budget 2023 was secured with the corresponding profits.

Hence, among the priority tasks of Ukrainian diplomacy and the non-governmental sector remains further persuasion of Ukraine’s Western partners of the need for new sanctions, greater density of the adopted sanctions regimes and limitation of Russia’s revenues from exports of energy resources. Such an approach is in the interests of both Ukraine and the EU, as Russia is waging war in Europe.

3. SITUATION ON EUROPEAN ENERGY MARKETS AND UKRAINE

3.1. EU sanctions: Effectiveness and impact

The imposition of Western sanctions against Russia, triggered by its new armed invasion of Ukraine on February 24, 2022, has an undeniable effect on Moscow, though it is mostly political so far. Oil revenues, which account for ~70% of total energy exports, remain the main power source for the engine of Russian military aggression.

The sixth package of EU sanctions, adopted on June 3, 2022, bans maritime imports of Russian oil from December 5, 2022, and imports of petroleum products from Russia from February 5, 2023. Hungary, Slovakia and the Czech Republic, which will continue to buy oil from the Southern Druzhba system, as well as Bulgaria and Croatia, received an exception to the embargo—the exempted volumes may amount, according to preliminary estimates, to 400,000 barrels of crude oil per day.

According to the IEA[8], total Russian oil exports have fallen slightly from ~8 mb/d in early 2022 to 7.4 mb/d in July, a decline of about 600,000 b/d since the beginning of the year. Oil and petroleum product flows to the U.S., the U.K., EU, Japan, and Korea have fallen substantially, by nearly 2.2 mb/d since the war began, two-thirds of which has been redirected to other markets, notably PRC and India.

The reorientation of oil and oil product flows from the EU, the U.S., Japan, Korea, the U.K. to China, India and Türkiye and the seasonal high consumption of oil in the Russian domestic market had the consequence that Russian oil and oil product production fell in July 2022 by only 310,000 b/d compared to pre-invasion levels in Ukraine. According to the IEA, the EU embargo on imports of Russian oil and oil products, which will come into force in February 2023, is expected to result in the need to replace about 1 mb/d of oil products and 1.3 mb/d of crude oil from Russia in the European market.[9]

The U.S. is making efforts to increase the amount of oil on the world market. These actions are supported by the July visit of the U.S. president to Saudi Arabia, the resumption of negotiations with Iran on the renewal of the 2015 Joint Comprehensive Plan of Action (JCPOA) nuclear agreement, which, if successful, could open the way for the export of large quantities of Iranian oil. Even Russian government estimates indicate that if sanctions were lifted on Tehran, Iranian oil would replace 50% of Russia’s supply to the EU market—1.4 million b/d of the 2.7 million that continue to be delivered. However, as a result of the coordinated actions of Russia and Israel, it was possible to thwart a return to the nuclear agreement at least until the end of this year, and no Iranian oil will enter the market by then[10].

Saudi oil has been already effectively replacing Russian oil in Europe. The dynamics of Iraqi oil shipments to the EU are also on the rise. There is increasing availability of U.S. oil on the global market. In general, all the above allows the U.S. and the G7 countries to counteract the OPEC+ cartel and Russia at the same time. This can be seen in the downward trend, albeit with bounces, in oil prices starting in mid-June—from over $120 a barrel to less than $90 in early fall of this year.

There is no unanimity in the views of economists and analysts as to how the partial EU oil embargo will affect the further development of the Russian oil trade. Some of them believe that this ban will hit the Russian economy hard, others suggest that the consequences will not be serious for some time, due to a number of factors, in particular the exemption of certain countries from the ban, mechanisms of circumventing sanctions, existing opportunities for reorientation of Russian oil exports to China, India and Türkiye. So far, Rosneft’s profits have increased by 13% in the first half of 2022, despite the partial sanctions[11].

3.2. Ukraine: Consequences of military actions for oil products market

The destruction by the enemy of the Kremenchuk refinery and 28 oil depots[12], the shutdown of the Shebelynskyi GPP ahead of the Russian invasion, and the cessation of supplies of oil products from Russia and Belarus due to the war they unleashed against Ukraine have shaped a new reality in the fuel market. At the same time, the war revealed with particular salience the obsolete structural diseases of the sector, which had been formed over the past 30 years.[13]

Before the full-scale invasion on February 24, 2022, out of six refineries in Ukraine, only the Kremenchuk refinery remained in operation, loaded to 20% of its design capacity. No strategic oil reserves for petroleum products were created, Ukraine’s dependence on imported fuel from Russia and Belarus in 2021 exceeded 70%[14], and the state had no idea how to replace the fuel volumes in the balance. New supply diversification routes were hardly worked out until February 24, as commercial priorities prevailed over security. All these factors, amplified by the wartime risks put by traders into the price of petroleum products, led to a sharp jump in prices and a shortage of fuel on Ukraine’s petroleum products market in the first months of the war.

Since late May and early June this year it was possible to mitigate the negative effects of the war on the fuel market, stabilize prices for petroleum products and partially overcome fuel shortages at filling stations by a set of measures, in particular by increasing the efficiency of state market regulation and creating a new “logistical leg,”[15] where petroleum products come from European ports and the new supply geography from Poland, Lithuania, Hungary, Romania, Germany, the U.S., the Netherlands and Belgium. A stable delivery of petroleum products remains a strategic priority because they are essential for the Ukrainian Armed Forces’ military equipment, logistics and transportation needs. This requires a reliable long-term solution through the creation of new pipelines or the conversion of existing ones connecting Ukraine to neighboring EU countries.

3.3. Situation at the European gas market: Energy solidarity in action?

The escalation of prices on the EU gas market in 2022 was continued on the part of Gazprom which stopped pumping gas through the Yamal-Europe pipeline, decreased the volume of pumping through the Ukrainian route to a minimum of 40 million cubic meters per day and manipulatively decreased the gas pumping five times through Nord Stream 1 during the period of active filling of European UGS facilities.

High gas prices contribute to a decline in industrial production, accelerate recession, and undermine EU solidarity on the need for further sanctions against Russia. According to respected American energy historian Daniel Yergin, the war in Ukraine has put Europe in a position the continent has never been in before and Russian President Vladimir Putin is “using gas to create economic hardship and political turmoil in Europe [and] he’s going to continue to do that.”[16]

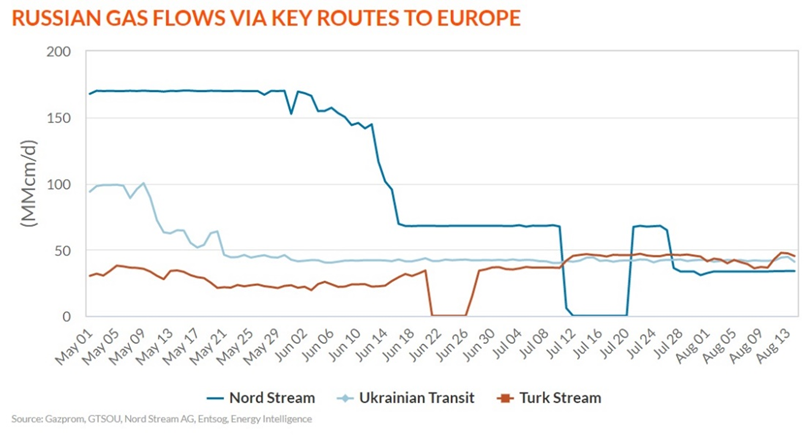

Putin’s gas streams are being used to manipulate routes and supply volumes. The TurkStream has been the main route for Russian gas to Europe in terms of daily volumes since midsummer this year (see Figure 2).

Figure 2. Russian gas flows via key routes to Europe

Manipulation of supply volumes and routes is a traditional tool of Gazprom. Steady pipeline gas supplies to Hungary, with agreements on additional volumes, are used by the Kremlin to encourage Budapest to further cause rifts in the EU sanctions policy and undermine European solidarity on military support for Ukraine.

Fatih Birol, head of the IEA, pointed out frankly that next winter will be a test of European energy solidarity[17]. Germany and the EU must have a united voice and defend the position jointly. Exclusion from sanctions destroys the coordinated stance, solidarity and indulges the aggressor. It is this lack of solidarity that has led to a number of EU companies agreeing to the illegal unilateral demand of the Russian Federation to switch to payment in rubles for imports, allowing Gazprom to cut off gas supplies to companies in 12 EU countries.

It is worth recalling that last year the EU Court of Justice set the record straight on the issue of energy solidarity. The decision of the Court of July 15, 2021 regarding the gas pipeline OPAL (Poland vs. Germany) is important not only because of restrictions on the use of capacities of Nord Stream 1, but primarily in terms of the obligation of Member States to use in practice the principle of energy solidarity, since this principle is one of the cornerstones of the functioning of the entire European Union, according to Article 194 (1) of the Treaty on the Functioning of the EU[18].

Article 194 (1)

In the context of the establishment and functioning of the internal market and with regard for the need to preserve and improve the environment, Union policy on energy shall aim, in a spirit of solidarity between Member States, to:

(a) ensure the functioning of the energy market;

(b) ensure security of energy supply in the Union;

(c) promote energy efficiency and energy saving and the development of new and renewable forms of energy; and

(d) promote the interconnection of energy networks.

The Court of Justice of the EU proved that “solidarity appears in primary EU law as values and goals that guide to a greater extent the political and economic decisions of the EU.”[19] Not surprisingly, Germany’s position was defeated at the EU Court of Justice. Poland won a convincing legal victory. However, Warsaw complains about Berlin’s disregard, both in the past and now, of reservations about the use of Russian offshore gas pipelines across the Baltic Sea. And this is seen not only in Warsaw, but also in Kyiv and other capitals.

Germany should not make any unilateral moves towards Russia, yet unfortunately it does, as we can observe in the case of the turbines for Nord Stream. By the time Russian gas is completely replaced, imports from Russia should be carried out via the Ukrainian route and Yamal-Europe, as it functioned before Putin’s streams. All other routes should be blocked. Then it would look like sanctions and a manifestation of energy solidarity between the EU and Ukraine.

By the way, Article 338 of the EU-Ukraine Association Agreement contains the following: “b) establishing effective mechanisms to address potential energy crisis situations in a spirit of solidarity.”[20] Another essential argument is Section 2 “Energy Security, Solidarity and Trust” of the Ukraine-EU Memorandum on the 2016 Strategic Energy Partnership. Chapter 2 clearly states: “The Sides seek to strengthen their mutual energy security in a spirit of solidarity and trust.”[21]

The text of the Energy Community Treaty also contains the principle of solidarity: “The Parties…. resolved to establish among the Parties an integrated market in natural gas and electricity, based on common interest and solidarity.”[22]

Based on the above, we have the right to demand the application of the principle of energy solidarity with us both on the part of the EU and individual countries that are both members of the EU and parties to the Energy Community Treaty. It is precisely Russia’s actions that have created the preconditions for crises and abuses on the gas market for both Ukraine and the EU, so it is time to practically apply the aforementioned provisions on energy solidarity.

Further course of events with gas flows from Russia will depend on the consolidated position of the European gas community—a number of EU gas organisations whose activities are defined within the EU—ACER/CEER, GIE, ENTSO-G, ENTSO-E, national regulators, gas infrastructure operators, gas supply companies and gas traders, gas importers, network users, gas consumer organisations and gas stock exchanges. The European gas community must be free of any direct or indirect influence from the aggressor and its lobbyists.

If the EU solidarity fails the winter test of the Russian energy blockade of Europe, then, as IEA head Fatih Birol rightly noted, “the implications may well be beyond energy.”[23]

4. CRITICAL ENERGY INFRASTRUCTURE: THE VULNERABILITIES OF UKRAINE AND EUROPE

4.1 Russian scenario of Ukraine’s energy deficit

Having failed to inflict an energy defeat on Ukraine through hybrid methods, Russia has resorted to seizing and destroying energy infrastructure during the current phase of aggression against Ukraine and Europe. The goal is to cause Ukraine’s energy shortage in order to dictate capitulation terms to Kyiv. To this end, Russian troops seized Enerhodar, where the country’s largest generating capacity, the Zaporizhzhia NPP (6 GW) and the Zaporizhzhia TPP (3.6 GW), are located. The Russians were also very close to capturing the South Ukrainian NPP. However, their offensive was repulsed by the Ukrainian Armed Forces. Russia’s nuclear blackmail and threatening scenario will continue until Enerhodar is liberated by the Ukrainian Armed Forces.

Thermal power, which plays an important role as shunting capacity for nuclear generation, sustained the greatest damage. Thermal power plants and heating plants in Donbas—in Sievierodonetsk, Lysychansk, and Svitlodarsk—as well as in Mariupol, Kremenchuk, Chernihiv, and Okhtyrka were destroyed or critically damaged.

The rocket attack on Ukraine’s second most powerful CHPP-5 in Kharkiv on September 11 was of a symbolic nature. It was a deliberate action that would resonate with the Al Qaeda attacks in the United States on September 11, 2001 and demonstrate to Ukraine and the West that Russia acts decisively and knows no boundaries in waging war. It was encouraged by J. Biden’s September 6 statement[24] that the U.S. would not recognize Russia as a state sponsor of terrorism. In fact, the August ultimatum of the Russian Foreign Ministry to break off relations with the U.S. in the event of such recognition of Russia[25] worked. It gave the Kremlin confidence in the impunity of continuing the practice of missile and energy terror in Ukraine and energy war against Europe.

Russia’s further pursuit of the scenario of energy-political blackmail of Europe by reducing gas supplies, in particular via Nord Stream and steamrolling the launch of Nord Stream 2, or the Kremlin’s possible political decision to halt gas exports to the EU at all, poses a threat of Ukraine stopping transportation via its GTS. In such a situation, Russia’s hands will be fully untied regarding destructive actions against Ukraine’s gas infrastructure amid an aggressive war unleashed by Moscow. This scenario could be initiated in late autumn or early winter so that Ukraine would have a destroyed energy infrastructure for the winter with no option of restoring its functionality promptly.

4.2 Potential multicrisis scenario for Europe.

In order to force the EU to reconsider sanctions against Russia and stop supporting Ukraine, Moscow is making efforts to chaotize Western countries and, above all, EU member states. Today’s economy is dependent on the infrastructure of information transfer. Approximately 95% of intercontinental information traffic (e-mail, phone calls, money transfers, etc.) is transmitted via FOCLs laid on the seabed. “Technical incidents” can occur “suddenly” on transatlantic fiber-optic communication lines (FOCLs) between Europe and North America. Breaking them could have serious economic and security implications. There is no generally accepted procedure for responding and dealing with FOCL emergencies.

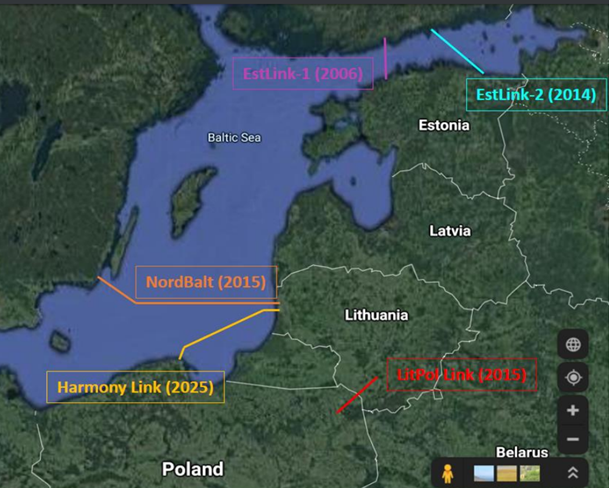

There are submarine cables on the bottom of the Baltic Sea that provide energy and information flows between NATO member states and the European Union. In addition to the FOCLs, power cables are also laid across the Baltic Sea to transmit electricity. These include SwePol Link between Sweden and Poland, Gotland, connecting the Swedish mainland to the island of Gotland, and the Baltic cable from Herrenvik (Sweden) to Lübeck (Germany) (see Map-Scheme 1).

Map-Scheme 1: The Baltic Sea submarine energy connections.

It is obvious that they will be targets for the top-secret Main Directorate of Deep Sea Research of the Russian Defense Ministry, the activity of which has already been repeatedly spotted in recent years in different areas of the Baltic, North Sea and North Atlantic.

4.3. Modeling the military attack on the EU (the example of the Eastern Baltic)

In case of military invasion of one or more EU and NATO member states by the Russian Federation, the Russian Armed Forces will act according to the pattern developed in Ukraine.

Cyberattacks on vulnerable electric power systems of EU countries, which in recent years have been working in unstable modes due to excessive share of renewables in national energy balances, pipeline networks for transportation of gas, oil and oil products are quite expected. And it could follow the template of the cyberattack on the Colonial Pipeline in the United States in 2021, when the operation of the strategically important fuel supply system was blocked.

Diversion, missile attacks and aerial bombardment could be carried out against LNG terminals, oil ports and submarine interconnectors (Balticconnector, Baltic Pipe) located in the sea and coastal zones. Targets in the Southeast Baltic Sea region are the fixed LNG terminal in Świnoujście (Poland) and the floating storage and regasification units (FSRU) in Klaipeda (Lithuania), and in Paldiski (Estonia) and Inkoo (Finland), oil ports and tank farms for storage of oil and oil products in Muuga (Estonia), Ventspils (Latvia), Būtingė (Lithuania), and Gdansk (Poland), as well as refineries in Lithuanian Mažeikiai and Polish Gdansk and Płock.

The objects of the attacks would be tank farms to store oil products, which are used to power equipment of the Polish Army and the U.S. forces in Poland, and 19 storage bases of oil products operator of Poland’s oil transportation system PERN. Oil storages for the strategic oil reserve on the territory of Poland and Baltic states will also become targets. Of course, it will not be possible to destroy oil reserves in IKS Solino salt caverns, but the defeat of the above-ground infrastructure will make them unusable. The above-ground infrastructure of 7 underground gas storage facilities in Poland and Inčukalns UGS in Latvia will evidently be targets for missile strikes or sabotage actions as well. Large thermal power plants, such as Belchatów and Kozienice, are supposed to be attacked, especially the 400 kV high-voltage substations, which would disrupt the stability of the energy system.

Seizure of nuclear facilities for further blackmail and ultimatum seems very likely. Targets in the Baltic Sea region include Finland’s Loviisa and Olkiluoto and Sweden’s Forsmark and Oskarshamn nuclear power plants. In the Black Sea, the Cernavodă nuclear power plant in Romania, 60 kilometers off the coast, could also become an object of capture for further nuclear blackmail by the EU and NATO.

5. CONCLUSIONS

Russia will receive enough profits from energy exports during 2022 to keep waging war against Ukraine in 2023. In 2023, the incomes will collapse, funding will experience a slight budget cut, but the war will continue due to the mobilization by the center of funds from the regions and local oligarchic groupings.

The EU has made a strategic decision to replace Russian gas and other energy sources with non-Russian ones. Measures to substitute Russian gas require coordinated joint action and sustained political efforts in many sectors, an energy solidarity and security dialogue between the EU and Ukraine as an EU candidate.

The EU lacks the political will to embargo Russia. The former has been actively promoting a plan to reduce gas consumption and imports from Russia in the context of measures to achieve climate neutrality, rather than defeat Russia, which regards the European gas market as a theater of war.

The liberalized gas market, which has been developed over many years in Europe and which implied security of supply, reliability, price predictability, and, finally, a positive impact on end users, proved incapable of self-regulation under Russian domination. The European Commission did not provide a timely and effective response to Gazprom’s hybrid actions aimed at price escalation disguised by market factors.

A number of EU countries have opted out of Russian gas, and several have been denied supplies from Russia because they refuse to pay in rubles. Gazprom keeps blackmailing Europe with gas supply restrictions and escalating gas prices on the EU market and blocking political will through Russia’s Trojan horse, Hungary.

Abnormally high gas prices on the spot market and rising energy costs for consumers are provoking resentment among citizens of member states and political crises. Nevertheless, the EU will have a sufficient UGS filling rate of up to 95% before the beginning of the heating season, which will bolster its resilience against Russia.

The EU and Ukraine, as an EU candidate, must have a unified voice and advocate their interests in the energy war with Russia in solidarity. No exceptions from the sanctions should be made. Such exceptions destroy the coordinated position, solidarity and indulge the aggressor. The preparation for and going through the winter period in the energy sector needs coordination of efforts in energy supply, the maximum levelling of risks of infrastructure destruction.

An authoritarian international regime fueled by the corrupt flows of the Kremlin’s gas and petrodollars will hardly be able to prevail over Europe. The formula for effectively countering Russia’s war in Europe consists not only of sanctions, but primarily of energy solidarity among EU and NATO member states and transatlantic solidarity in the form of LNG supplies from the United States. The LNG bridge across the Atlantic must work like the air bridge during the Soviet land blockade of West Berlin in 1948-1949. Standing up now, as it was then, is critical for the West, Europe, and Ukraine.

[1] https://www.reuters.com/business/energy/france-accuses-russia-using-gas-weapon-war-2022-08-30/

[2] https://www.eeas.europa.eu/eeas/what-more-can-we-do-ukraine_en

[3] http://www.energystrategy.ru/projects/es-2020.htm

[4] https://ec.europa.eu/commission/presscorner/detail/ov/SPEECH_22_5493

[5] https://lenta.ru/news/2022/09/04/postavchik/

[6] https://www.interfax.ru/business/827895

[7] https://tass.ru/armiya-i-opk/15561377?utm_source=google.com&utm_medium=organic&utm_campaign=google.com&utm_referrer=google.com

[8] https://www.iea.org/reports/oil-market-report-august-2022?mode=overview

[9] Ibid.

[10] https://zn.ua/ukr/international/jak-rosija-ta-izrajil-zirvali-jadernu-uhodu-iranu-i-ssha-ta-jak-tse-stosujetsja-ukrajini-.html

[11] https://markets.businessinsider.com/news/commodities/russian-oil-crude-kremlin-billion-sanctions-war-ukraine-us-europe-2022-9

[12] https://www.ukrinform.ua/rubric-economy/3481038-rosiani-zrujnuvali-v-ukraini-27-naftobaz-ta-zavdali-zbitkiv-na-227-miljoniv-kse-institute.html

[13] https://razumkov.org.ua/statti/kryzovyi-stan-rynku-naftoproduktiv-prychyny-vysnovky-rekomendatsii

[14] https://ua-energy.org/uk/posts/importni-misheni

[15] https://ukurier.gov.ua/uk/articles/uryad-napracyuvav-rishennya-z-podolannya-deficitu-/

[16] https://markets.businessinsider.com/news/commodities/energy-crisis-outlook-fed-interest-rates-are-influencing-oil-2022-9

[17] https://www.france24.com/en/tv-shows/people-profit/20220908-iea-director-says-energy-crisis-a-test-for-european-solidarity

[18] https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=CELEX:12012E/TXT:en:PDF

[19] https://curia.europa.eu/jcms/upload/docs/application/pdf/2021-07/cp210129en.pdf

[20] https://zakon.rada.gov.ua/laws/show/984_011#Text

[21] https://zakon.rada.gov.ua/laws/show/984_003-16#Text

[22] https://zakon.rada.gov.ua/laws/show/994_926#Text

[23] https://www.france24.com/en/tv-shows/people-profit/20220908-iea-director-says-energy-crisis-a-test-for-european-solidarity

[24] https://www.voanews.com/a/biden-says-no-to-appeals-to-designate-russia-a-state-sponsor-of-terror/6734357.html

[25] https://tass.ru/politika/15462269?utm_source=google.com&utm_medium=organic&utm_campaign=google.com&utm_referrer=google.com

References

- http://www.energystrategy.ru/projects/es-2020.htm

- https://curia.europa.eu/jcms/upload/docs/application/pdf/2021-07/cp210129en.pdf

- https://ec.europa.eu/commission/presscorner/detail/ov/SPEECH_22_5493

- https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=CELEX:12012E/TXT:en:PDF

- https://lenta.ru/news/2022/09/04/postavchik/

- https://markets.businessinsider.com/news/commodities/energy-crisis-outlook-fed-interest-rates-are-influencing-oil-2022-9

- https://markets.businessinsider.com/news/commodities/russian-oil-crude-kremlin-billion-sanctions-war-ukraine-us-europe-2022-9

- https://razumkov.org.ua/statti/kryzovyi-stan-rynku-naftoproduktiv-prychyny-vysnovky-rekomendatsii

- https://tass.ru/armiya-i-opk/15561377?utm_source=google.com&utm_medium=organic&utm_campaign=google.com&utm_referrer=google.com

- https://tass.ru/politika/15462269?utm_source=google.com&utm_medium=organic&utm_campaign=google.com&utm_referrer=google.com

- https://ua-energy.org/uk/posts/importni-misheni

- https://ukurier.gov.ua/uk/articles/uryad-napracyuvav-rishennya-z-podolannya-deficitu-/

- https://www.eeas.europa.eu/eeas/what-more-can-we-do-ukraine_en

- https://www.france24.com/en/tv-shows/people-profit/20220908-iea-director-says-energy-crisis-a-test-for-european-solidarity

- https://www.iea.org/reports/oil-market-report-august-2022?mode=overview

- https://www.interfax.ru/business/827895

- https://www.reuters.com/business/energy/france-accuses-russia-using-gas-weapon-war-2022-08-30/

- https://www.ukrinform.ua/rubric-economy/3481038-rosiani-zrujnuvali-v-ukraini-27-naftobaz-ta-zavdali-zbitkiv-na-227-miljoniv-kse-institute.html

- https://www.voanews.com/a/biden-says-no-to-appeals-to-designate-russia-a-state-sponsor-of-terror/6734357.html

- https://zakon.rada.gov.ua/laws/show/984_003-16#Text

- https://zakon.rada.gov.ua/laws/show/984_011#Text

- https://zakon.rada.gov.ua/laws/show/994_926#Text

- https://zn.ua/ukr/international/jak-rosija-ta-izrajil-zirvali-jadernu-uhodu-iranu-i-ssha-ta-jak-tse-stosujetsja-ukrajini-.html

© Centre for Global Studies «Strategy ХХІ»

Group of authors:

Mykhailo Gonchar, Oksana Ishchuk, Ihor Stukalenko

The information and views set out in this study are those of the author and do not necessarily reflect the official opinion of the Konrad-Adenauer-Stiftung e.V. or the Ministry of Foreign Affairs of Ukraine.

Centre for Global Studies «Strategy ХХІ»

Shchekavytska str, 51 office 26

Kyiv, 04071, Ukraine

Е-mail: info@geostrategy.org.ua